Tax Planning for Your Financial Institution in the Current Environment

In the current environment of increasing interest rates, margin pressure, inflation, potential recession, and high-profile bank failures, earnings are potentially squeezed from every direction. Faced with this uncertainty, tax planning might feel more daunting than it does in strong economic times; however, careful monitoring, and the ability to quickly adapt to changes is critical. What should banks consider on the tax front that they may have previously disregarded? Let’s discuss re-framing tax planning for a less robust economic outlook.

Interest Expense Disallowance

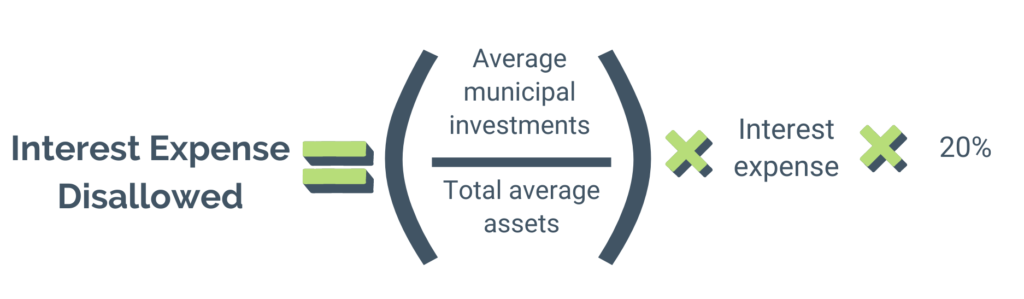

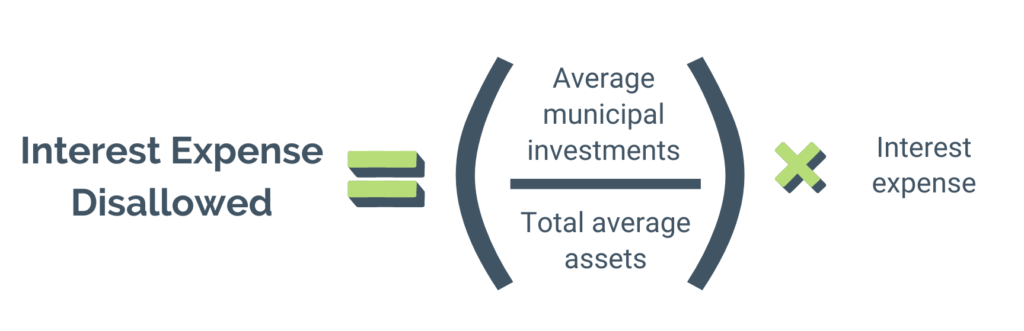

Many banks are familiar with Section 265 and the limitation on interest expense deduction related to municipal investments and municipal loans. Depending on whether a municipal investment is bank qualified or non-bank qualified (see this article for a further discussion), there is a portion of interest expense that is presumed to be associated with tax-exempt income and is not allowed as a deduction. Recently, institutions are experiencing interest rates increasing at a rate different from the rate that total assets are growing. The formula for interest expense disallowed is a function of municipal investments over total assets multiplied by interest expense.

For bank qualified:

For non-bank qualified:

As interest expense grows at a disproportional rate to total assets, it is possible that the nondeductible interest expense could be larger and start to impact the internal rate of return on municipal investments. As banks continue to price municipal investments, they may need to consider the impact of higher interest expenses and the portion allocated as nondeductible.

Effective tax rate

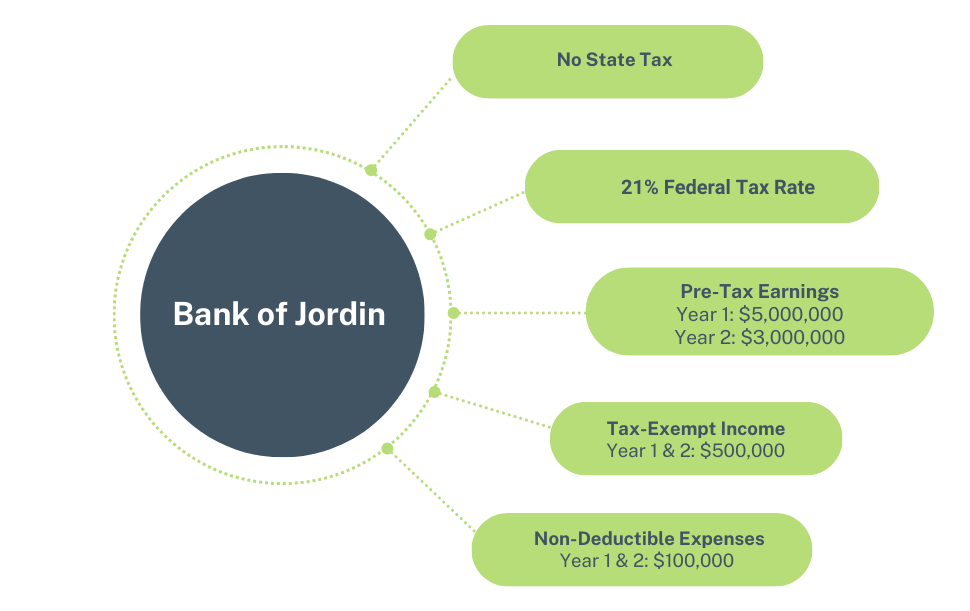

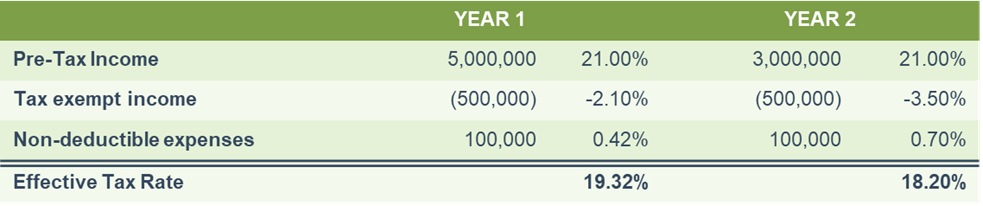

As margins are squeezed and the potential for reduced pre-tax earnings grows, banks could also see shifts in their effective tax rates. Factors such as interest expense disallowance could have greater impact on the effective tax rate. Additionally, a decrease in pre-tax earnings could cause other permanent differences, such as bank owned life insurance or tax credits, to have a greater influence on the effective tax rate (both positive and negative) as the numerator (i. e., municipal income or banked owned life insurance tax effect) may stay the same but the denominator (i.e., pre-tax earnings) is smaller.

For example, if the Bank of Jordin has the following fact pattern:

Effective Tax Rates:

If tax exempt income and non-deductible expenses stay similar year over year (in total dollars), the effective tax rate in year 2 would be lower because municipal income has a bigger impact with the smaller denominator of pre-tax earnings.

The bigger picture here is to manage expectations regarding effective tax rates and to keep their fluidity and potential impact in mind when creating your budget.

Tax Credit Capacity

Over the past few years, many financial institutions have enjoyed higher earnings and higher levels of taxable income. This has allowed them to invest in low-income housing, historic, solar, or other tax credits, and be able to reap the benefits of the credits in the years they are generated. However, if taxable income is decreased, total tax will also decrease and accordingly, the amount of tax able to be offset by tax credits.

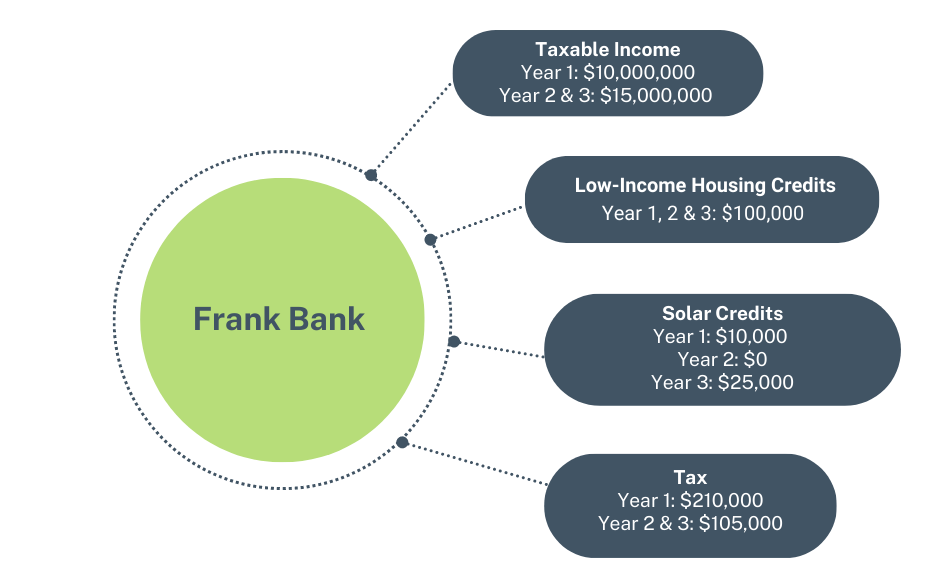

Let’s consider another example. Frank Bank has the following fact pattern:

In year 1, the net tax after credits is $100,000 ($210,000 -$10,000 (solar credits) and $100,000 (housing credits)).

In year 2, Form 3800 (the form in which the credits are claimed) will likely limit the credits. Let’s say credits are useable up to 75% of the tax – in other words, $78,750 of credits used. The remaining credits could be carried from year 2 to year 1, as general business credits get carried back one year and carried forward up to 20 years.

However, in year 3, tax credits will be more than the tax base yet again and there is no capacity to carryback; therefore, the credit will be carried forward, no immediate cash benefit is recognized, and the benefit is deferred. If this occurs year after year, the carryforward could grow until taxable income is sufficient to allow the carryforward to be used.

Again, this is part of the investment decision process. Low-income housing credits are typically consistent over the 10-year period, so do you plan to be able to use them? If not, does the deferred benefit change your rate of return on these investments? Alternatively, some credits, like the solar credit, tend to come all in year 1, so you have some ability to adjust up and down on the credit, but you may need to wait for a year of increased earnings to get the full benefit, which could affect the rate of return. If banks are starting to near capacity, planning for such before investments are made becomes important to make sure you do not eat away at the benefit too much via deferral.

Conclusion

While this article has focused on three topics, there are a host of other considerations that often interplay. Net operating losses could become a factor. Or what if you have a large capital project that creates significant bonus depreciation in one year? What impact would that have on tax credits or other deferrals? Perhaps 163(j) could come into play, especially for low income investments that may require financing at higher rates and lead to larger disallowed interest expense (see more here).

This is a just a sample of other tax issues, questions, or impacts that could arise. The key takeaway here is that your tax-planning must change with, and respond to, changes in the economy. The importance of various strategies shifts with the current market and legislative outlook. A holistic view of tax planning is extremely important, and projections and budgets are key to avoid surprises. No one wants to make an investment only to find out they won’t benefit until year 3 with no view of whether future high inflation could significantly impact the value you originally anticipated! In today’s environment, it’s important to have a knowledgeable and experienced team of tax specialists to help you navigate your tax planning roadmap.

For more information or a discussion on how this may impact your bank, please contact Adam Aucoin or your BNN tax advisor at 800.244.7444.

Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.