The One Big Beautiful Bill and Community Banking

At times it seems like Congress only has two speeds – lighting fast or deathly slow. This bill seemed to follow the former. At the end of May, I wrote about the beginnings of the One Big Beautiful Bill (OBBB) when the legislation, in an earlier form, passed the House. That article covered the initial ideas and discussions for tax provisions. The final version of the OBBB kept some of those items, nixed others, and added new provisions.

At Baker Newman Noyes we have created a series of articles over this bill. At the risk of sounding like the passenger in a car who tells you to go “that way” (but of course you are driving and focusing on the road so “that way” really has no directional impact), an overall summary article published on July 9 tends to be the best primer on the bill and links to a plethora of other content in a manner that should provide you with much better direction than “go that way!”

This article extracts and explains the features relevant to specific readers: those concerned with the taxation of financial institutions. While the summary article is almost certainly going to have major implications for bank customers, what about the bank itself? This article focuses mostly on C Corporation banks, because they are more prevalent in our primary practice area in the Northeast and because S Corporation financial institutions have many other considerations.

Provisions to Watch

To put it mildly, there are numerous tax provisions in this voluminous bill. Many of these focus on individual taxation and passthrough taxation. The impact to C Corporation financial institutions consists of a handful of provisions and tends to be focused on temporary, as opposed to permanent, differences. The Tax Cuts and Jobs Act legislation (TCJA) passed in 2017 had more immediate impact, with its change in the corporate tax rate and changes to permanent differences such as Internal Revenue Code (IRC) Section162(m), meals and entertainment, and parking. Each bank has its own facts and circumstances, but with the OBBB, the items that appear most impactful include:

- expansion and extension of accelerated depreciation provisions,

- immediate expensing of domestic research & experimental expenses,

- 1% floor on charitable contribution deduction,

- exclusion of 25% of interest from certain rural and agricultural real estate loans, and

- clean energy phaseouts.

Depreciation

What’s old is new again. Depreciation has undergone many changes in tax treatment over the past few decades, with 100% bonus available for many of those years. Bonus depreciation has been phasing down over the past several years, though, allowing far less than 100% as an immediate write-off. This bill reinstates, and makes permanent, 100% bonus depreciation for qualified assets acquired and placed in service after January 1, 2025.

Additionally, the bill increases the opportunity for current deduction of certain asset costs under IRC Section 179. Starting in 2018, Section 179 permits full expensing of qualified property up to $1,000,000 annually (indexed for inflation such that the maximum deduction for 2025 is $1,250,000). This deduction is subject to a phase-out once the total cost of eligible property placed in service exceeds $2,500,000 (indexed for inflation such that the 2025 amount is $3,130,000). The OBBB increases the annual deduction cap to $2.5 million and lifts the phase-out threshold to $4 million (both indexed for inflation) for property placed in service in taxable years beginning after December 31, 2024. Section 179 is a great alternative to bonus depreciation and sometimes is preferable to bonus depreciation due to state tax considerations.

The ability to accelerate (or decelerate) depreciation continues to provide many opportunities for financial institutions. Whether to accelerate or not and the resulting interplay with the utilization of tax credits and carryforwards is a big lever that can be pulled to varying positions with tax planning, cost segregation studies, and careful analysis of the tangible property regulations.

R&E Expenditures

Banks with the criteria to be impacted by it are all too familiar with the impact of rules in very recent years that forced them to capitalize, rather than immediately deduct, Section 174 Research and Experimental (R&E) expenditures. Those banks, in turn, will appreciate the magnitude of favorable changes to these rules in the BBB. At the core, the new rules return the ability to immediately expense domestic (but not foreign) R&E expenditures for years beginning after December 31, 2024, with some options to accelerate deduction of costs previously capitalized under now superseded rules. There are a number of variables in the new rules that dictate how, when, and to what extent the new rules “undo” the prior rules, and some questions remain regarding how to implement some of them. Yours truly published a much more in-depth article on this topic a few days ago, and financial personnel in impacted banks should reference it for more details on this significant change.

1% Charitable Floor

The OBBB created what is becoming an under-the-radar “pay for.” Not everything in the bill can serve to reduce tax, because this bill followed a very unique so-called “reconciliation” process that imposes some guardrails on how far off from revenue-neutral this legislation could be. Tax increases will result from a new feature that creates a floor for deductible charitable contributions.

Many financial institutions are integral parts of their community and they tend to make numerous and often large donations to various charitable organizations. The bill’s new 1% floor on contributions is likely to be unwelcome news to many C Corporation financial institutions.

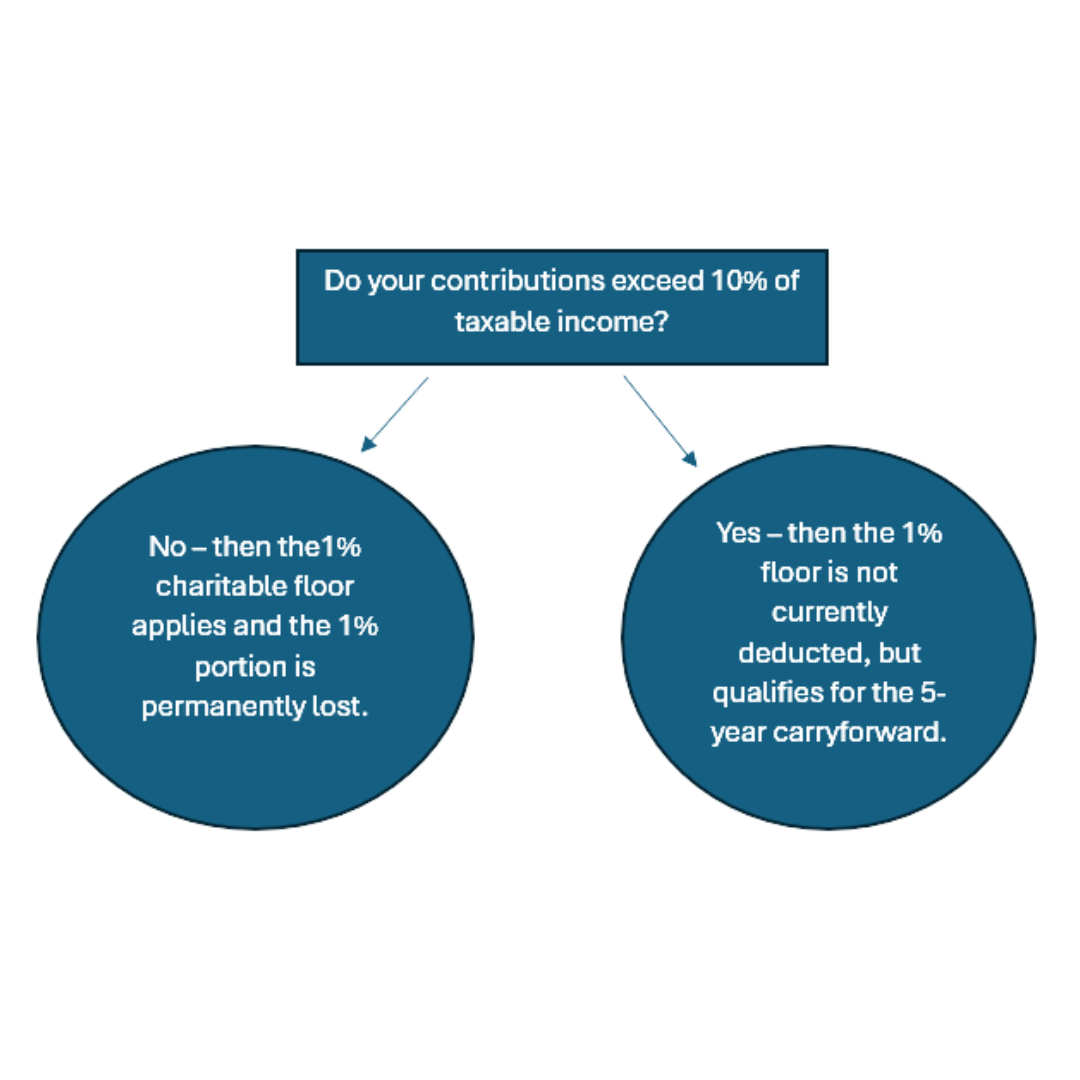

Under current law, deductions for charitable contributions are limited in any one year to 10% of taxable income (computed without consideration of any charitable contribution deduction itself or the dividends received deduction). Anything disallowed because it exceeds the 10% limit is given a 5-year carryforward window. That does not change in the new law. What does change is the first 1% will not be immediately deductible for taxable years starting after December 31, 2025. That portion will be treated in one of two ways, entirely dependent on whether the 10% cap was reached. If contributions remain below 10%, the 1% portion is permanently lost. However, if you trip the 10% threshold, doing so sort of sanitizes the 1% piece, allowing it to join the portion of contributions that exceed 10%, with both being eligible for the 5 year carryforward window.

This creates some planning opportunities. Do you intentionally trip the 10% threshold to avoid the 1% floor in one year? (Doing so will maximize your deductions.) Do you consider bunching contributions to trip the lines some years and not in others? This is all going to depend on projected future taxable income, current taxable income, charitable intentions and desires, and net present value considerations, etc. Any bank hovering around the 10% limit currently should begin modeling out over a multi-year span to see if there are potential savings, net of present value factors. Is the savings material enough to change giving strategies? Are you pushing contributions into a year of greater earnings where the 1% floor could be a larger number?

On top of all this, from a tax provision perspective, the 1% floor is a temporary item in years where the 10% ceiling is reached, and a permanent item in years where the 10% ceiling is not reached, so there may or may not be an effective tax rate impact. However, the 1% limit is based on taxable income which might not be known until year-end. Estimates or other calculations may be needed in interim periods to estimate what that 1% floor in any given year might be.

In the two comparative examples below, both assume an entity earns $15,000,000 over a 3-year period and makes charitable contributions totaling $1,200,000 spread over that same period. They differ only in the timing of those variables. It shows that an entity has some control over the outcome, but one must ask whether the tax savings are outweighed by any net present value considerations.

| Alternative 1 | ||||||

| 2026 | 2027 | 2028 | Totals | |||

| Taxable Income | 4,600,000 | 5,200,000 | 5,200,000 | 15,000,000 | ||

| Charitable Contributions | 800,000 | 200,000 | 200,000 | 1,200,000 | ||

| Taxable Income for Charitable Limit | 5,400,000 | 5,400,000 | 5,400,000 | 16,200,000 | ||

| 10% Limit | 540,000 | 540,000 | 540,000 | 1,620,000 | ||

| Over the 10% limit? | YES | NO | NO | |||

| 1% Floor | 54,000 | 54,000 | 54,000 | |||

| Deductible Contribution Expense | 486,000 | 460,000 | 146,000 | 1,092,000 | ||

| Carryforward to Following Year | 314,000 | – | – | |||

| Not Deductible Permanently | – | 54,000 | 54,000 | 108,000 | ||

| Total Deductible Over 3 Years | 1,092,000 | |||||

| Total Not Deductible Over 3 Years | 108,000 | |||||

| Tax Impact at 21% | 22,680 | |||||

| Alternative 2 | ||||||

| 2026 | 2027 | 2028 | Totals | |||

| Taxable Income | 5,000,000 | 5,000,000 | 5,000,000 | 15,000,000 | ||

| Charitable Contributions | 400,000 | 400,000 | 400,000 | 1,200,000 | ||

| Taxable Income for Charitable Limit | 5,400,000 | 5,400,000 | 5,400,000 | 16,200,000 | ||

| 10% Limit | 540,000 | 540,000 | 540,000 | 1,620,000 | ||

| Over the 10% limit? | NO | NO | NO | |||

| 1% Floor | 54,000 | 54,000 | 54,000 | |||

| Deductible Contribution Expense | 346,000 | 346,000 | 346,000 | 1,038,000 | ||

| Carryforward to Following Year | – | – | – | |||

| Not Deductible Permanently | 54,000 | 54,000 | 54,000 | 162,000 | ||

| Total Deductible Over 3 Years | 1,038,000 | |||||

| Total Not Deductible Over 3 Years | 162,000 | |||||

| Tax Impact at 21% | 34,020 | |||||

| Net Tax Savings by accelerating deduction | 11,340 | |||||

25% Rural loan interest tax exemption

The OBBB finally includes a provision that has, in some form, been lobbied by many banking associations for many, many years now – most recently in the form of the ACRE Act (which was not passed). That bill called for 100% tax exemption for loans secured by rural or agricultural real property, which did not come to fruition. The OBBB doesn’t go that far, but it introduces a 25% exemption. This provides a new tax-exempt vehicle for financial institutions to consider, both in effective tax rate planning, and structure and pricing of certain loans.

The bill exempts 25% of the interest (for banks and other qualified entities) earned from qualified rural or agricultural loans for loans made after July 4, 2025. Note that re-financing an existing loan will not qualify the loan for the exemption.

It is important to understand the definition of qualified real estate loans. The bill defines a qualified real estate loan as one of the following two points:

- Loans secured by rural or agricultural real estate.

- This is defined as real property where one or more of three following apply:

- Real property which is substantially used to produce one or more agricultural products

- Real property which is substantially used in the trade or business of fishing or seafood processing

- Any aquaculture facility (such as a hatchery, rearing pond, raceway, pen, or incubator)

- A leasehold mortgage (with a status as a lien) on rural or agricultural real estate.

- This is defined as real property where one or more of three following apply:

These loans cannot be made to a specified foreign entity and must be made after enactment of the bill (July 4, 2025).

Additionally, much like municipal investments, these loans are subject to IRC Section 265, which may allocate a portion of interest expense as non-deductible. (See more on section 265 for municipals in a September 2018 article.)

There potentially is a lot to unpack with this new tax exemption. Here are a few potential steps to consider:

- Do we have loans that currently meet this criterion and how do we flag them in our system? How do we track qualified loans going forward? (Consider isolating the interest income from these loans post enactment date and placing the loans themselves in separate general ledger accounts.)

- Does this feature create an incentive to get involved with this type of lending or expand it?

- Consider how to price these loans and what the rate of return will be, given both the tax-exempt portion of the interest income and the related interest expense disallowance under Section 265.

- Consider the impact on your effective tax rate and how it plays into overall tax strategies (recalling that it creates permanent difference).

Clean Energy Tax Credits

The clean energy market was completely revamped in 2022 with the passage of the Inflation Reduction Act. It created numerous new clean energy credits, expanded many existing credits, and created a powerful new tool called transferability. OBBB dramatically curtails the impact of these tax credits. For many financial institutions this could have significant impacts on tax credit strategies. Many banks either have equity investments in clean energy partnerships or have availed themselves of the transferable market (see more on that in my article published in June of 2024). Many taxpayers have enjoyed the one-year-at-a-time nature of many of these credits which is a powerful tool as you try to toggle up and down your tax credits in any given year and manage your effective tax rate. These changes to clean energy credits will start removing one of the tools in the effective tax rate planning shed. If you are considering investing in any of these projects or have historically used these investments as a tax strategy, you should consult with your advisors on proper course corrections.

What’s next

Modeling, planning, and discussion are needed next. Planning for the 1% contribution limitation, deciding how changes to the clean energy incentives impact your tax strategies, and how to price rural loans, etc. all need discussion throughout the rest of this year and into the future. Like all legislation, the devil is in the details and new things will be learned as we continue to digest and apply these new rules, so please continue to chat with your tax advisor and stay up to date on insights we provide.

I’ll reiterate here that there are a lot of other tax provisions that can and are likely to apply to financial institutions such as 1099 reporting (on auto loans, new thresholds, etc.). This article is meant to focus on just five specific topics and is not meant to cover all possible items of relevance.

For more information or a discussion on how this may impact your bank, please contact Adam Aucoin or your BNN tax advisor at 800.244.7444.

Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.